PRESCRIPTION DRUG PLAN: Private insurance companies offer Medicare prescription drug coverage, that covers brand name and generic prescription drugs. You can enroll in a prescription drug plan if you are entitled to Medicare Part A and/or enrolled in Medicare Part B and live in the service area.

INITIAL ELECTION PERIOD: In general, an individual is eligible to enroll in a Part D plan when an individual is entitled to Part A and/or Part B and lives in the service area of a Part D plan. Individuals who are becoming eligible for Medicare will have an initial election period for Part D that is the 7-month period surrounding Medicare eligibility. The initial election period begins 3 months before the month an individual meets the eligibility requirements for Part B and ends 3 months after the month of eligibility.

ANNUAL ELECTION PERIOD: This period is between October 15th and December 7th. During this period you can make a new plan choice with new coverage beginning on January 1st of the following year.

SPECIAL ELECTION PERIOD: During this special election period, you can make a new plan choice if you meet certain circumstances as mandated by CMS, for example, moving to a new service area, you plan is non-renewable, or you are newly eligible for Medicaid.

LATE ENROLLMENT PENALTY: The late enrollment penalty is an amount added to your Medicare Part D premium. You may owe a late enrollment penalty if, at any time after your initial enrollment period is over, there is a period of 63 or more days in a row when you don't have Part D or other creditable prescription drug coverage, like through an employer. The cost of the penalty depends on how long you went without creditable prescription drug coverage.

FORMULARY: The list of medications covered by your Medicare Part D plan. If your prescription drug is not on your plan's formulary, you will have to pay the full amount of the cost of the drug.

DRUG TIERS: In most Part D plan formularies, covered medications are placed into one of four tiers that are used to determine the amount of your copayment and coinsurance.

PREMIUMS: Your premium is the amount you pay to the company each month to maintain your coverage. Premiums can be paid by coupon book, electronic transfer out of your checking account, or it can come directly out of your social security check.

DEDUCTIBLE: Your annual deductible is the amount you will be required to pay out-of-pocket before your copays will begin. Not all plans have a deductible, and the plans change every year.

COPAYMENT: Your "copay" is the dollar amount or percentage you are required to pay up front for a specific prescription drug, depending on what tier the prescription drug is classified in. You pay copays until the total drug costs, including patient and plan contributions, reach $2850.

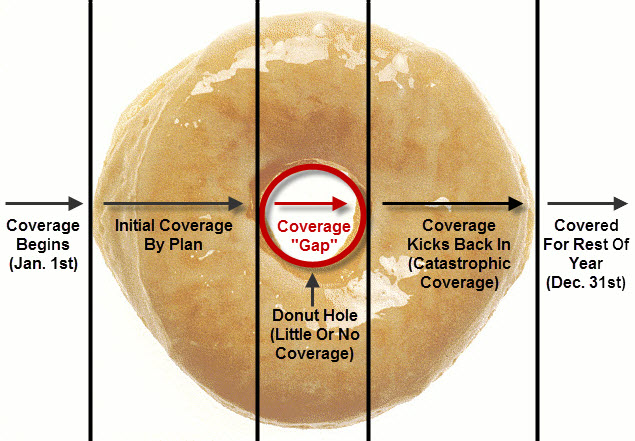

COVERAGE GAP (DONUT HOLE): When you and the plan have contributed $2850, you have reached the donut hole, which you will pay the majority of the cost of the prescription drug, until you have paid out of pocket costs totaling $4550.

CATASTROPHIC COVERAGE: Once you have paid $4550 out of pocket for your prescriptions, you then begin your catastrophic coverage, which means you will pay a small percentage for your prescriptions, typically 5% for the rest of the year.